By now, you already know that churn is one of the major enemies of any startup business. But up to this point, you are often dealing with what is known as voluntary churn. That is, customers willingly cancel their subscriptions.

However, there is another type of churn you might not notice. This is involuntary churn, which can have a more significant impact on your profits. Let’s explore what it is and how you can deal with it through Virtua Solutions’ help.

Understanding How Involuntary Churn Works

In its simplest definition, involuntary churn is when a customer’s subscription gets canceled without them intending to do so. That can happen due to various reasons, including the following:

- A customer can’t log in to their account

- They forgot to renew their subscription on time

- They have outdated payment information, causing errors in the renewal process.

- The customer can’t get a demo of the product

- They can’t afford your product any longer

In such situations, the customer might abandon their account without formally canceling. Or your system automatically cancels their subscription without them realizing. Either way, you lose customers without realizing it right away.

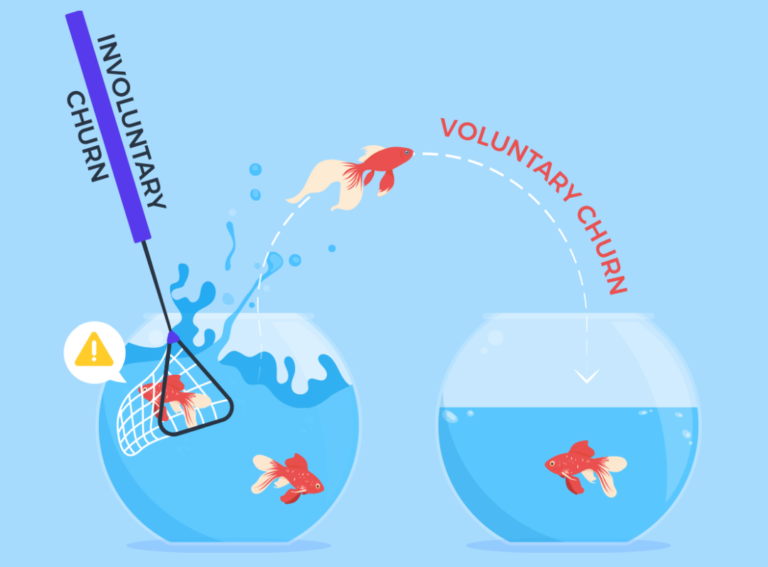

Voluntary Vs. Involuntary Churn

As you can see, the two types of churn differ mainly in how the cancellation happens. However, these types can tell you more about the customer situation. By understanding their differences better, you can create a more effective strategy to deal with both.

Image from Verifone.

Image from Verifone.

In the case of voluntary churn, the customer proactively cancels their subscription. That can indicate a problem in the overall customer experience. People may find something they do not like enough to cancel their subscription. Or they may feel that the product is not enough to satisfy their needs. Whichever it is, that signals you to look deeper into your CX strategy to determine the issue.

In involuntary churn, however, the customer might still very much love your product. But these issues can frustrate them since they can’t enjoy it seamlessly. However, it is worth noting that this churn is not always your fault. Customer mistakes can also lead to it. Nevertheless, it is still your responsibility to help them avoid such situations so they can enjoy your product more.

Payment Issues: The Most Common Trigger For Involuntary Churn

Of the above reasons, payment issues are often the most common ones that induce involuntary churn. When customers have a hard time trying to pay for your service, they quit. As such, you want to understand what is happening here exactly to determine the best solutions.

Here, customers can encounter one of two payment issues within your billing system.

Soft Declines

These are the temporary issues that they might encounter when sending payment to you. They include:

- Insufficient funds in their card or bank account

- Exceeded their transaction activity limit

- Expired cards

- Processing timeouts

In most cases, resolving these soft declines can be done by just refreshing the payment page and trying the process again. However, if the issue persists, you might need to check if it’s your payment system which might have issues.

With the bank or card issues, customers can just redo the payment after they have sorted their accounts. Here, you want to make it easy for them to bring up their cart again for processing.

Hard Declines

The other payment issue is when there is a permanent authorization failure in the processing. It can be due to the following reasons.

- A stolen or lost card

- Invalid credit card data

- Closed account

When these failures happen, customers won’t be able to recover the transaction. They should also not retry the transaction using the same data, as they can end up being permanently blocked.

How Your Startup Business can Prevent This

Being very common, your startup company needs to address payment issues immediately to avoid churn. That work begins with choosing the payment processor for your company. You want to get one that offers automatic update features. As their name says, these will update the payment information without the customer having to enter it manually. Some processors can even let you process alternative cards for payment.

Additionally, you can help customers remember to update their payment information. For instance, you can send notifications about possible card expiry. You can arrange this through the payment processor themselves.

Other Ways Your Startup Business Can Prevent Involuntary Churn

Unlike the voluntary one, you can prevent involuntary churn. But you should be more proactive instead of just responding when customers bring it up. Start by ensuring that your checkout page is well-optimized.

One thing that you can do here is to prompt users to update their information before leaving. That works in tandem with sending them notifications through email. But make sure that the notifications are not intrusive so as not to be ignored.

Don’t Lock Customers Out Of Your Service

Often, companies lock customers out of their services upon initial payment failure. While this is a preventive measure to avoid fraud, it can backfire on legitimate customers. When they get locked out, they might take this as a signal to drop your service.

Instead, you can send notifications within your service dashboard about what is happening. You can also put a paywall that they can quickly fill up to re-access the service. All of these will ensure they can continue to use your product effortlessly.

Helping Your Startup Business Help Customers

Beyond these safeguards, you need to provide active support to your customers. But with other concerns you deal with, these involuntary churn incidents can still slip through. Virtua Solutions is ready to help you avoid that happening.

We will serve as your frontline team in dealing with payment concerns. For instance, we can tackle concerns about updating customer payment information. Our agents can also routinely check if the information stored in your customer database is accurate.

Virtua Solutions can also help you coordinate with payment processors. This is an essential step to ensure that you and they are on the same page regarding these concerns. Our agents will connect with these processors and work out the various adjustments needed to enable proper payment.

Dealing with involuntary churn as soon as possible will ensure that your startup business and its customers are interacting smoothly. Virtua Solutions is always ready to help you achieve that goal. Sign up today and let’s get started doing more for your customers.

Related Resources: